A major rift is widening between institutional and retail investors, reflecting one of the most striking sentiment divides in recent market history. Recent data shows that as U.S. equities rebounded, professional investors took the opportunity to sell, while individual investors stepped in to buy with growing confidence.

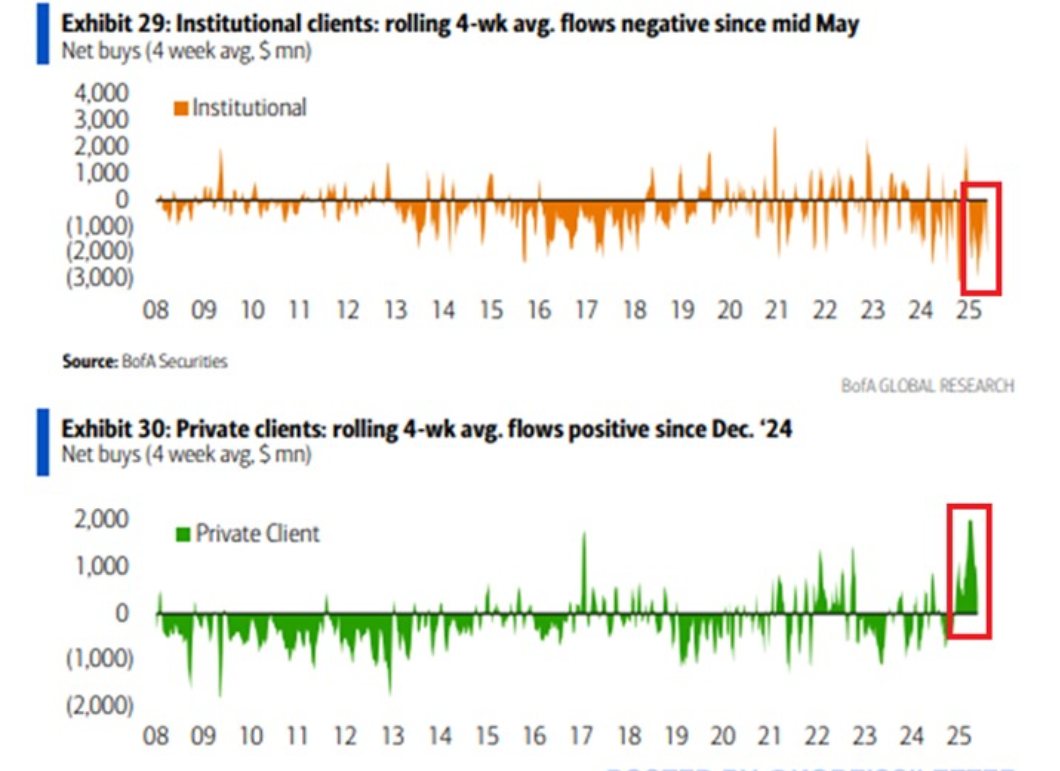

Over the last week, institutional investors sold $4.2 billion in U.S. equities. This is part of a broader trend — in the past four weeks, average institutional net outflows have reached $2.0 billion per week. This selling trend marks a clear negative flow pattern that has persisted since mid-May 2025.

Zooming out to a long-term view, institutional net buying has fluctuated frequently since 2008, with notable sharp sell-offs during major market stress periods. However, the recent stretch shows one of the more persistent and concentrated selling phases in recent years. Even during previous periods of volatility, institutional flows often rebounded quickly. This time, the outflows are not only sustained but also accelerating, indicating growing caution or strategic de-risking among large investors.

In contrast, private client flows — representing retail investors — tell a completely different story. Last week alone, retail investors bought $700 million worth of U.S. equities. Over the past four weeks, their average weekly net purchases have reached $400 million. Furthermore, over a 12-week period, private clients have been consistent net buyers, adding an average of $1.6 billion in U.S. stocks weekly.

The shift in retail activity has been building since December 2024, with steady and positive net inflows. This contrasts with the previous years, where private client flows were often negative or minimal. After years of lower engagement, retail investors now appear to be aggressively entering the market, especially during periods when institutional confidence is faltering.

Looking at historical behavior since 2008, retail flows have generally been reactive, dipping during financial shocks and rising modestly during stable periods. However, the recent spike in buying activity is among the most significant surges seen in over a decade.

This diverging behavior raises key questions about market direction and sentiment interpretation. Institutions, often driven by macroeconomic models and valuation discipline, are pulling back. Retail investors, likely driven by optimism, momentum, and accessible trading platforms, are pushing forward.

Such a pronounced gap in behavior is unusual and could have meaningful implications. Either retail investors are capitalizing on undervalued opportunities missed by professionals, or institutional caution is a signal of deeper underlying risks that retail traders are overlooking.

The coming weeks could prove pivotal in determining which side of this divide has made the correct call.

Disclaimer:

This article is for informational purposes only and should not be construed as financial advice. Please consult a certified investment advisor before making any investment decisions.