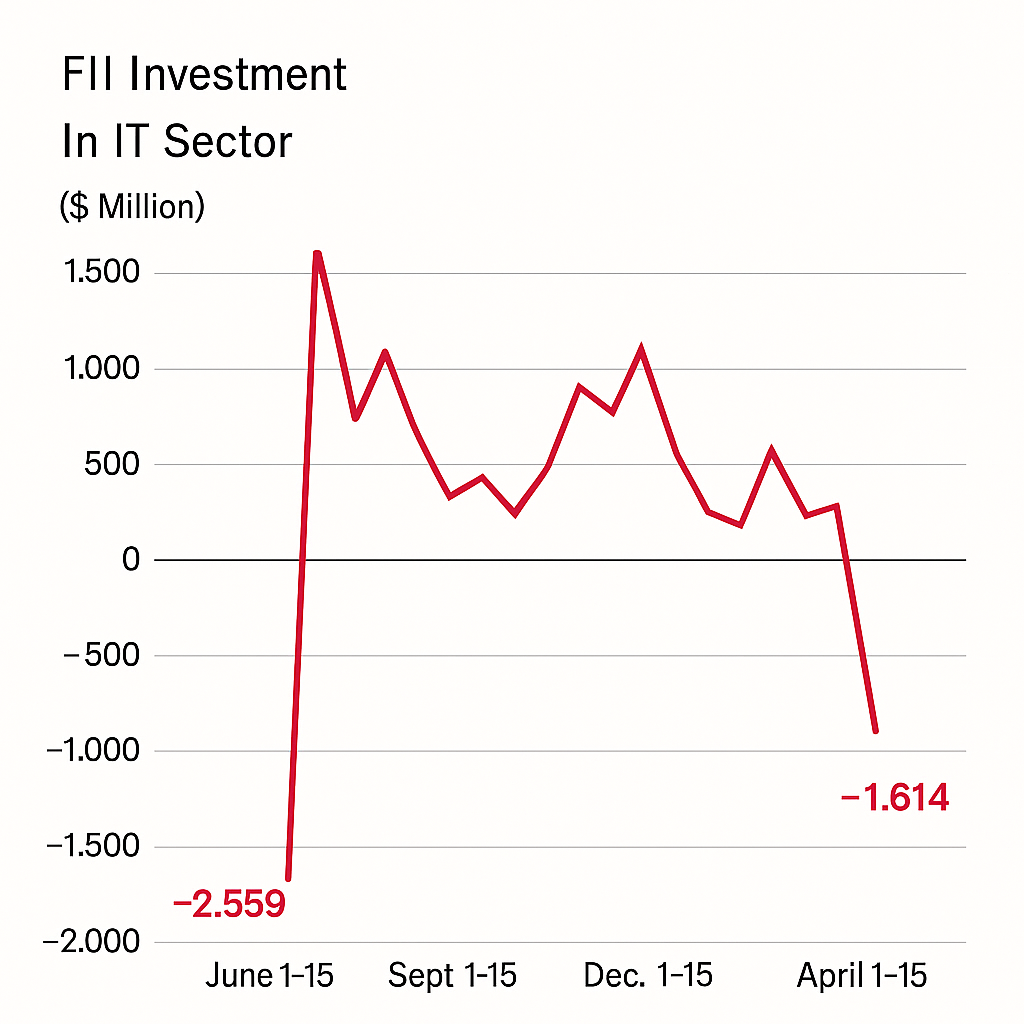

The numbers are finally out and they are painting quite worrisome picture of Indian IT sector. Between April 1st to April 15th Foreign institutional investors (FIIs) have offloads whopping $1,614 Million Worth of IT shares and this is the officially Worst sectoral outflow since June 2024 when FIIs dumped even bigger $2,559 Million worth of IT Shares

This sudden selling definitely raised eyebrows of across Dalal Street and this Selling has just happened in nine trading sessions with this NIFTY IT index Plunges by 10%,TCS and Infosys are the biggest contributors

So What's Triggered Selloff?

US Recession Fear:Due to ongoing Tariff war between China and USA many Analyst believe that US likely to enter in Recession,And US markets is main source of revenue for Indian IT companies, Almost 60% of Revenue Comes from USA only so if Enters in Recession it will be negative for IT companies

Weak Q4 Results: TCS Infosys and Wipro Posted Their results and results are not tha attractive TCS profit fell by 2% YoY and condition with Infosys although Wipro's Profit rises but it has given cautious outlook for upcoming quarters

Tech Selloff in US Markets:US tech index fallen heavily in last some weeks due to Trump's Tariff buzz and recently Trump puts some restrictions on NVIDIA this is also triggered Selloff in Ustech index

Disclaimer:

This blog is for educational and informational purposes only. The opinions shared here are purely personal and do not constitute investment advice.