The first quarter of FY26 has brought a mixed bag of results for India’s top IT companies—TCS, HCLTech, Wipro, and Tech Mahindra. As global macroeconomic challenges continue to shape client spending and project pipelines, these tech giants have reported varied performance across revenue growth, profitability, margins, and strategic direction.

While TCS maintained its leadership in profit and deal wins, Wipro surprised with the highest profit growth. HCLTech pushed forward with AI-led initiatives and improved guidance, whereas Tech Mahindra continued to face operational headwinds. This blog takes a deep dive into the Q1 FY26 performance, dividend announcements, and management insights from each of these industry leaders.

Tata Consultancy Services (TCS): Solid Profits Despite Demand Contraction

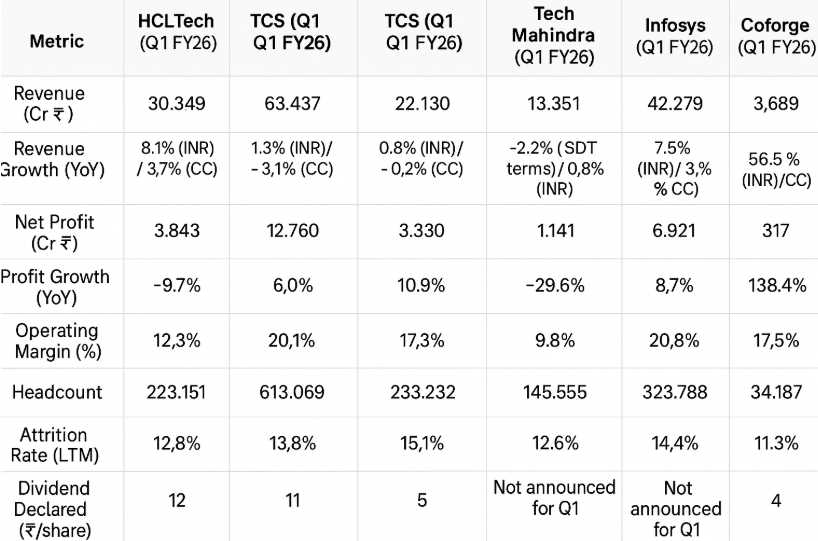

TCS maintained its position as the largest Indian IT company by revenue and net profit. It reported a revenue of ₹63,437 crore for Q1 FY26, up 1.3% YoY in INR terms but down 3.1% in constant currency (CC). Net profit stood at ₹12,760 crore, marking a 6% increase YoY. Operating margin stood at 24.5% and net margin at 20.1%, the highest among its peers. The total employee count was 6,13,069, with an attrition rate of 13.8%.

TCS also declared an interim dividend of ₹11 per equity share for FY26, with a record date of July 16, 2025, and payment scheduled for August 4, 2025.

Management Commentary:

CEO K Krithivasan acknowledged a challenging demand environment due to global macroeconomic and geopolitical uncertainties. He highlighted robust deal closures totaling $9.4 billion and noted that new services saw healthy growth. Despite discretionary spending pressure and delays in decision-making, he remains optimistic about improved international performance later in the fiscal year.

CFO Samir Seksaria stated that operating margins improved by 30 basis points sequentially. While demand pressures hurt utilization, this was balanced by reduced third-party costs and currency benefits. The company remains committed to its long-term aspiration of achieving 26-28% operating margins.

CHRO Milind Lakkad said hiring would be calibrated based on demand. He clarified there was no headcount reduction due to AI, only job role transformations, and noted that attrition at 13.8% was slightly above the desired comfort level of 13%.

HCLTech: Strong Revenue Growth, AI-Focused Transformation

HCLTech posted ₹30,349 crore in revenue for Q1 FY26, reflecting 8.1% YoY growth in INR terms and 3.7% in constant currency. However, net profit fell 9.7% YoY to ₹3,843 crore. The company maintained an operating margin of 16.3% and a net margin of 12.7%. It had a total headcount of 2,23,151 with an attrition rate of 12.8%.

The company declared an interim dividend of ₹12 per equity share. The record date is July 18, 2025, and the payment will be made on July 28, 2025.

Management Commentary:

CEO C Vijayakumar emphasized the 4.5% YoY growth in the Services segment (in CC terms) as a key driver. He noted that margins were affected by lower utilization and increased investments in Gen AI and go-to-market strategies. He highlighted HCLTech’s partnership with OpenAI and a restructuring program aimed at optimizing unutilized facilities and overseas talent pools. The company also revised its FY26 constant currency revenue guidance to 3-5% from 2-5%, citing stable demand and growing deal pipeline.

CFO Shiv Walia highlighted impressive cash generation, with Operating Cash Flow to Net Income at 129% and Free Cash Flow to Net Income at 121%, underlining the strength of HCLTech’s business fundamentals.

Wipro: Strong Profit Growth Amid Macroeconomic Challenges

Wipro reported revenue of ₹22,130 crore for Q1 FY26, with a marginal YoY increase of 0.8% in INR and a 0.2% decline in CC. Net profit surged 10.9% YoY to ₹3,330 crore—the highest among the four in terms of profit growth. Operating margin rose to 17.3%, and net margin stood at 15.1%. The company’s headcount was 2,33,232 with the highest attrition rate at 15.1%.

Wipro declared an interim dividend of ₹5 per equity share, with the record date set for July 28, 2025, and payment on or before August 15, 2025.

Management Commentary:

CEO Srini Pallia said clients were prioritizing efficiency and cost savings in a challenging macroeconomic climate. Wipro secured 16 large deals, including two mega-deals, with total bookings of $5 billion. He emphasized that AI has become central to clients' strategies.

CFO Aparna Iyer reported an 80 bps YoY improvement in margins and strong cash flow conversion, with operating cash flows at 123% of net income. She also mentioned that over $1.3 billion had been returned to shareholders in the past six months.

Infosys Q1 FY26: Solid Profit Growth, Strong AI Push

Infosys, India’s second-largest IT services exporter, reported a 7.5% YoY increase in revenue to ₹42,279 crore and a net profit of ₹6,921 crore, marking an 8.7% YoY growth for the quarter ended June 2025. The company also raised the lower end of its full-year revenue guidance to 1-3% (earlier 0-3%), indicating cautious optimism for FY26.

Key Highlights:

- Revenue: ₹42,279 crore, up 7.5% YoY

- Net Profit: ₹6,921 crore, up 8.7% YoY

- Operating Margin: 20.8%, slightly lower than the previous year

- Large Deal Wins: $3.8 billion

- Free Cash Flow: ₹7,533 crore, down 17.7% YoY but 108.8% of net profit

AI-Driven Transformation:

CEO Salil Parekh emphasized Infosys’ strength in enterprise AI capabilities. The company has deployed over 300 Agentic AI solutions, resulting in productivity gains of 5–15%. These AI tools are playing a significant role in improving decision-making, boosting efficiency, and driving client value.

Infosys also highlighted success in client consolidation, which was a key contributor to its stable performance amid a challenging global environment.

CFO Jayesh Sanghrajka noted that the resilient operating margins at 20.8QoQ growth of 2.6%, and EPS increase of 8.6% YoY reflected Infosys’ multi-pronged strategy and execution strength.

Coforge Q1 FY26: Profit Up, But Margins Under Pressure

Coforge Ltd. posted a 21.5% YoY increase in consolidated net profit to ₹317 crore in Q1 FY26, compared to ₹261 crore in the previous quarter. However, this missed analyst estimates of ₹335 crore.

Key Financials:

- Net Profit: ₹317 crore, up 21.5% YoY

- Margin: 11.3%, down from 11.8% in the previous quarter

Dividend Update:

Coforge declared an interim dividend of ₹4 per share, with a record date of July 31, 2025. This reflects the company's consistent shareholder return policy despite margin compression.

Sudhir Singh, Chief Executive Officer and Executive Director: Expressed confidence in Coforge's performance, citing a 9.6% sequential dollar growth in Q1, a 46% higher YoY signed order book for the next twelve months, and a clear path to 14% EBIT margin in FY26. He believes these factors point to an "exceptional fiscal." He also noted the industry's pivot towards AI, with Coforge leading through its "Quasar AI Marketplace," "AgentSphere" library, and real-world deployments.

- Operational Highlights: The company secured $507 million in new orders, signed 5 large deals, and expanded its headcount to 34,187. Coforge maintained a low attrition rate of 11.3%, which is among the best in the IT services industry, indicating strong employee retention. They also launched new AI-driven platforms like Forge-X and AgentSphere.

Tech Mahindra: Sharp Declines in Revenue and Profit

Tech Mahindra posted the weakest results among the four IT giants. Its revenue fell to ₹13,351 crore, down 2.2% in USD terms and 0.8% in INR terms. Net profit plunged 29.6% YoY to ₹1,141 crore. Operating margin was at 9.8% and net margin at 8.5%, both the lowest among the peer set. Headcount stood at 1,45,555, and attrition rate was the lowest at 10.8%.

No interim dividend was declared for Q1 FY26, in contrast to its peers. Historically, Tech Mahindra prefers announcing final dividends annually rather than interim ones.

Management Commentary:

CEO Mohit Joshi said the company’s performance is showing steady strengthening, aided by disciplined execution and a focused strategy. He pointed out a 44% increase in deal wins over the last twelve months, indicating recovery momentum.

CFO Rohit Anand highlighted that the firm had delivered seven consecutive quarters of margin expansion. He credited this to operational rigor under “Project Fortius,” which continues to yield improvements even in a volatile environment.

Conclusion: A Quarter of Divergence

The Q1 FY26 earnings of India’s top IT companies reflect a landscape of contrasts. While TCS and Wipro showcased stability in profitability and strong deal wins, HCLTech is banking on AI-led transformation to power future growth. In contrast, Tech Mahindra continues to face operational and demand-side challenges. With macroeconomic uncertainty still lingering, the second quarter will be pivotal in determining the trajectory for FY26.

Disclaimer:

This article is intended for informational purposes only and should not be considered as financial advice or a recommendation to buy or sell any securities. Investors are advised to do their own research or consult a financial advisor.