Tata Motors has released its shareholding pattern for the first quarter of FY26, showing some notable shifts in investor sentiment. India's largest domestic institutional investor (DII), Life Insurance Corporation of India (LIC), has increased its stake in the company to 3.89%, up from 3.15% in the previous quarter. This increase reflects continued confidence from institutional investors in Tata Motors' long-term prospects, despite ongoing global headwinds.

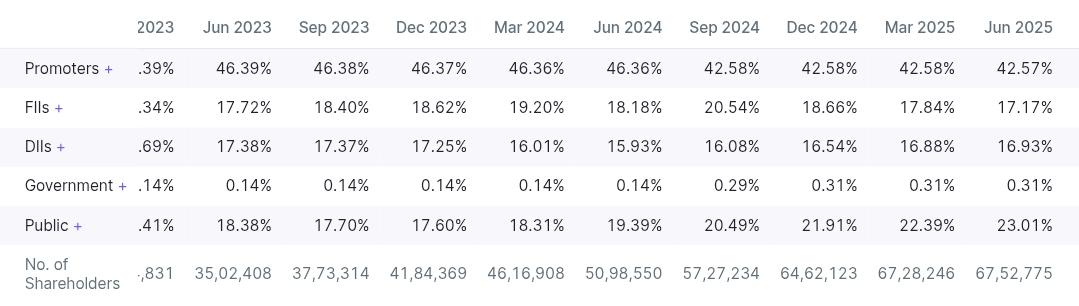

In terms of shareholding distribution for the quarter ended June 2025, promoters held a stable stake at 42.57%, marginally down from 42.58% in March 2025. Foreign Institutional Investors (FIIs) reduced their holdings from 17.84% to 17.17%, signaling a cautious approach in light of global trade developments. Meanwhile, Domestic Institutional Investors (DIIs) slightly increased their share to 16.93% from 16.88%. Government holding remained constant at 0.31%. Public shareholding rose from 22.39% to 23.01%, possibly indicating retail investor interest at current price levels.

The stock, however, continues to trade 40% below its peak levels. The primary reason lies in recent trade policies affecting Jaguar Land Rover (JLR), the UK-based subsidiary of Tata Motors. Under the earlier structure, vehicles entering the United States from outside faced a 2.5% import duty. However, after the announcement of new tariffs by former US President Donald Trump, this duty was significantly raised to 27.5% for vehicles manufactured outside the US.

While the UK government successfully negotiated a trade deal that reduced this tariff back to 10% for UK-manufactured vehicles, the impact is still severe for models like the Defender, which is produced in other parts of Europe. As a result, a substantial portion of JLR's lineup remains subject to the higher tariff, severely affecting profitability and cash flow expectations.

JLR management has already indicated that it expects zero free cash flow by the end of FY26 due to these tariff burdens and related challenges in global markets. The outlook remains uncertain, and investor sentiment is likely to remain cautious until a clearer resolution emerges around trade and tariff dynamics.

Despite these concerns, LIC's increasing stake signals a vote of confidence in the company's resilience and long-term fundamentals. With a significant domestic and export portfolio, Tata Motors continues to be a key player in the global automotive sector, even as it navigates a complex geopolitical and economic landscape.